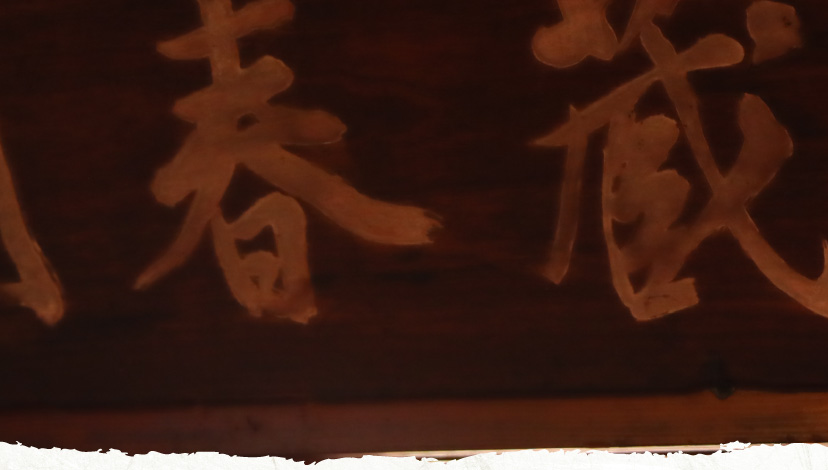

新着情報

若の屋の新着情報

Revenue Double Taxation Agreements

Revenue double taxation agreements, also known as tax treaties, are agreements between two countries that aim to eliminate or reduce the double taxation of income or profits arising in one country that are taxable in another. These agreements are designed to promote international trade and investment by providing clarity and certainty on taxation and preventing double taxation that might discourage cross-border transactions.

Double taxation occurs when two or more countries claim the right to tax the same income or profits of an individual or entity. This can result in a significant increase in the tax burden, reducing the profits of the business and discouraging cross-border investment. Revenue double taxation agreements, therefore, aim to address this issue by providing a framework for the taxation of income or profits.

Under a tax treaty, a resident of one country may be exempt from paying taxes or may be required to pay taxes at a reduced rate in the other country, depending on the type of income or profit. The agreement also provides a mechanism for the resolution of disputes that may arise between the tax authorities of the two countries.

Revenue double taxation agreements cover various types of income, including income from employment, dividends, interest, royalties, and business profits. They also address the tax treatment of capital gains, pensions, and other forms of income. The agreements typically include provisions on the exchange of information between the tax authorities of the two countries and the prevention of tax evasion and avoidance.

Businesses that operate in multiple countries are particularly impacted by the issue of double taxation. Revenue double taxation agreements provide clarity and predictability on the tax treatment of income or profits, which can help companies avoid the risks of double taxation and plan their operations more effectively.

In summary, revenue double taxation agreements are essential for promoting international trade and investment by providing clarity and certainty on taxation and preventing double taxation that might discourage cross-border transactions. As a professional, it`s vital to understand the importance of revenue double taxation agreements in today`s globalized business environment. Businesses that operate across borders would be wise to consult with tax professionals to ensure compliance with the relevant tax treaties and optimize their tax planning strategies.