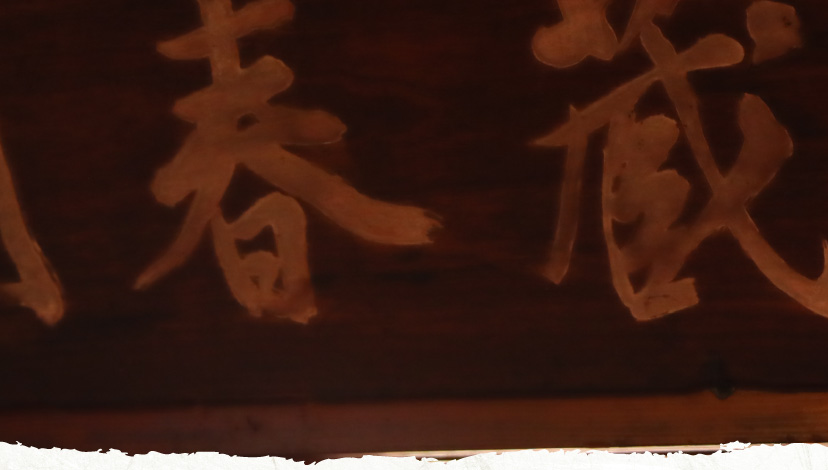

新着情報

若の屋の新着情報

Non-Recourse Loan Agreement

Non-recourse loan agreements are a type of loan agreement in which the borrower is not personally liable for the repayment of the loan. Instead, the lender looks to the collateral securing the loan as the primary source of repayment.

In a non-recourse loan agreement, the lender takes on a greater risk than in a traditional loan agreement. If the collateral securing the loan is insufficient to cover the outstanding balance of the loan, the lender cannot seek additional repayment from the borrower.

Non-recourse loan agreements are commonly used in real estate financing. For example, a borrower may obtain a non-recourse loan to finance the purchase of a commercial property. The commercial property itself serves as the collateral securing the loan. If the borrower defaults on the loan, the lender can foreclose on the property to recover its investment.

In addition to commercial real estate financing, non-recourse loan agreements may also be used for other types of loans, such as equipment financing or accounts receivable financing.

One advantage of non-recourse loan agreements is that they can provide borrowers with more flexibility in their financing options. Because the borrower is not personally liable for the loan, they may be able to negotiate more favorable terms, such as lower interest rates or longer repayment periods.

However, non-recourse loan agreements can also come with some disadvantages. Because the lender is taking on a greater risk, they may require more stringent requirements for the collateral securing the loan. This can make it more difficult for borrowers to qualify for non-recourse loans.

In addition, because the lender cannot seek additional repayment from the borrower if the collateral is insufficient to cover the loan balance, non-recourse loan agreements may have higher interest rates than traditional loans. This is to compensate the lender for the increased risk.

Overall, non-recourse loan agreements can be a useful financing option for borrowers in certain situations. However, it is important for borrowers to carefully consider the terms and requirements of the loan before entering into an agreement. As always, it`s recommended to consult with a financial advisor before taking on any form of debt.