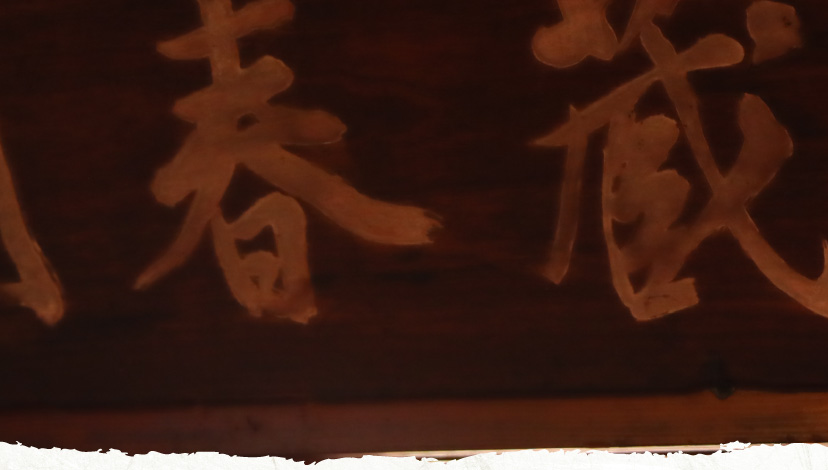

新着情報

若の屋の新着情報

Us Small Business Administration Loan Authorization and Agreement

If you`re a small business owner in the United States, you may be wondering how to secure financing to help your business grow. That`s where the Small Business Administration (SBA) comes in. The SBA offers a variety of loan programs to help small businesses access the funding they need to succeed.

One common type of SBA loan is the 7(a) loan program. This program provides loans up to $5 million to small businesses for a variety of purposes, such as working capital, inventory and equipment purchases, and debt refinancing.

If you`re interested in applying for a 7(a) loan, you`ll need to fill out an SBA Loan Authorization and Agreement (LAA) form. This form outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment terms, and collateral requirements.

Before you sign the LAA, it`s essential to review it carefully and make sure you understand all the terms and conditions. Some key things to look out for include:

- Loan amount: Make sure the loan amount you`re receiving is sufficient for your business needs. If it`s too low, you may need to seek additional financing elsewhere.

- Interest rate: The interest rate on your loan will determine how much you`ll pay in total over the life of the loan. Make sure you`re comfortable with the rate you`re being offered.

- Repayment terms: Be sure you understand when your payments are due and how much they`ll be. If you`re unsure about your ability to make the payments, it may be wise to explore other financing options.

- Collateral requirements: Depending on the size and purpose of the loan, the SBA may require you to offer collateral to secure the loan. Make sure you understand what assets you`ll need to pledge and what the consequences are if you default on the loan.

Once you`re confident in the terms and conditions of the loan, you can sign the LAA and begin the loan process. It`s essential to work closely with your lender throughout the process to ensure everything goes smoothly.

Overall, an SBA loan can be an excellent option for small businesses looking to access financing. By carefully reviewing and understanding the Loan Authorization and Agreement, you can make a smart decision for your business`s financial future.