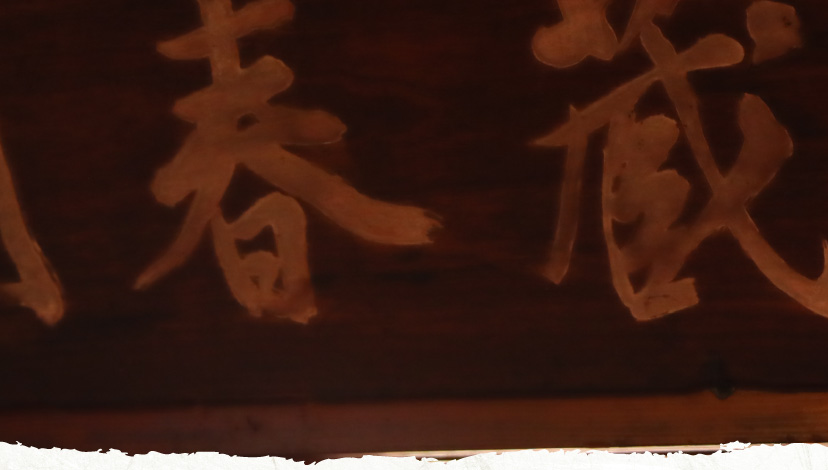

新着情報

若の屋の新着情報

Double Taxation Agreement Benefits

Double Taxation Agreement Benefits: Understanding the Advantages of Tax Treaties

Double taxation can be a source of frustration and financial burden for businesses and individuals operating in multiple countries. This is where double taxation agreements (DTAs) come in handy. These agreements between two countries aim to reduce the risk of double taxation and promote cross-border trade and investment. In this article, we will explore the benefits of DTAs and how they can save you money.

1. Avoidance of Double Taxation

DTAs are designed to prevent double taxation by setting rules on how tax authorities should allocate taxing rights on income and assets. The agreements ensure that income generated in one country is not taxed again in the other country, eliminating the risk of being taxed twice on the same income or transaction. As a result, businesses can reduce their tax liability, retain more profits, and have more funds available for reinvestment.

2. Elimination of Taxation Barriers

DTAs help to eliminate tax obstacles that hinder cross-border trade and investment. The agreements provide clear rules on tax treatments, thus reducing uncertainties and creating a level playing field for businesses. This encourages foreign investment and fosters economic growth, as businesses can expand their operations without the fear of being subject to discriminatory tax policies.

3. Increased Certainty and Transparency

DTAs provide a clear framework for the tax treatment of cross-border transactions. This includes setting out the tax rates that apply, the types of income that are covered, and the conditions for claiming tax credits and deductions. By providing clarity and transparency, DTAs increase legal certainty and reduce the risk of disputes and litigation.

4. Tax Credits and Deductions

DTAs often provide for the elimination of double taxation by allowing taxpayers to claim a credit or deduction for foreign taxes paid. This means that taxpayers can reduce their tax liability in their country of residence by the amount of tax paid in the foreign country. This provision ensures that taxpayers are not subject to higher taxes than they would have been if they had earned the income in their home country.

5. Mutual Agreement Procedure

DTAs provide for a mutual agreement procedure (MAP) to resolve disputes between tax authorities. If taxpayers believe that they are being unfairly taxed, they may make a request to the competent authority to resolve the dispute. The MAP offers a transparent and efficient process for resolving disputes, thus providing taxpayers with greater certainty and reducing the risk of double taxation.

In conclusion, DTAs are an essential tool for businesses and individuals operating across borders. They offer a range of benefits, including the avoidance of double taxation, the elimination of tax barriers, increased certainty and transparency, tax credits and deductions, and a mutual agreement procedure for resolving disputes. As a professional, it is important to highlight these benefits to ensure that individuals and businesses can access the advantages that DTAs offer.